The longevity business market is expected to grow from 301.8 million USD in 2019 to 524 million USD by 2026. Longevity companies such as Agex Therapeutics and Lineage Cell Therapeutics have attracted much attention as they flourished in the last two years. As a result, investors are looking for the winning horses to bid on for investment in the future.

Following the market crash caused by the COVID-19 pandemic, the longevity industry has defied all odds and witnessed many positive investment activities.

A timeskipper investing in longevity is on a double-mission – by investing in anti-aging companies we capture a business opportunity in a promising market, while also helping to accelerate scientific progress towards technological and biological advances that will enable longer life expectancy, preservation techniques, and the possible resurrection of cryopreserved patients.

Our former article gave a financial overview of the longevity industry and its major sectors. This post offers an overview of investment choices in the top longevity companies and funds, and why you should consider them for your investments.

Apollo Health Ventures (European Investment Fund)

Location: Berlin, Germany

Fundraised: $180 M.

Focus: Biotechnology & Anti-aging

Founder & CEO: Alexandra Bause

Apollo Health Ventures targets companies that can intervene in preventing and reversing aging. Their investment portfolio includes companies such as Aeovian Pharmaceuticals (San Francisco, USA), Cleara Biotech (Utrecht, Netherlands), and Samsara Therapeutics (Delaware, USA). These are pioneers in anti-aging therapy, cellular senescence elimination, and autophagy enhancements.

On December 1st 2021, the company announced the final closing of its second venture fund, raising $180 million to invest in data-driven biotechnology and health tech ventures.

A solid investment team stands behind Apollo Health Ventures, consisting of industry leaders, serial entrepreneurs, and investment professionals with a successful track record. Among these figures are people like Nils Regge (one of the most successful European serial entrepreneurs), Dr Jens Eckstein (over 25 years’ experience in biotech venture capital and leading roles at TVM Capital and SR One), and Dr Marianne Mertens (over 13 years’ experience in research, consulting, and the life science industry).

The year 2022 can offer investors in longevity venture capital a chance to join upcoming venture funding rounds led by Apollo Health Ventures. We advise you to stay informed on the latest from Apollo Health through their website and social media channels.

AgeX Therapeutics (NYSE American Stock: AGE)

Location: California, USA

Market Cap: $22.97 M.

Focus: Biotechnology & Antiaging

Founder: Michael West

AgeX Therapeutics has longevity at the core of its business. The company invests in novel anti-aging therapies.

The two leading proprietary technologies are PureStem® and induced Tissue Regeneration (iTR™). PureStem® enables many medicinal applications for the treatment of degenerative aging diseases. iTR™ is a longevity platform targeting longevity in cellular structures and increasing the regenerative capacity of body cells.

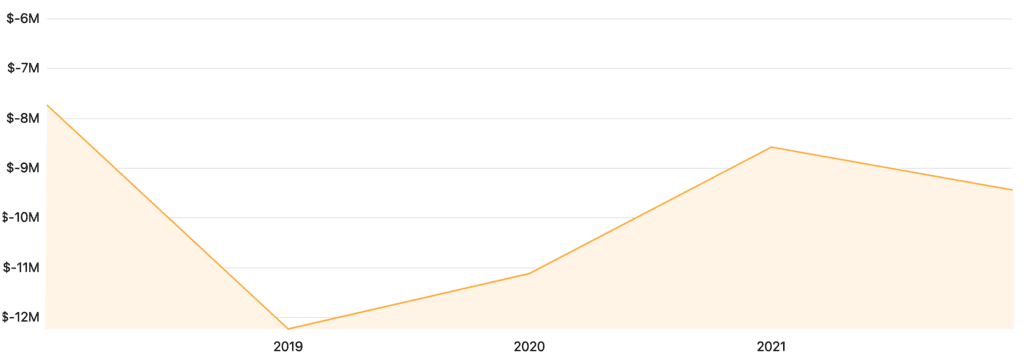

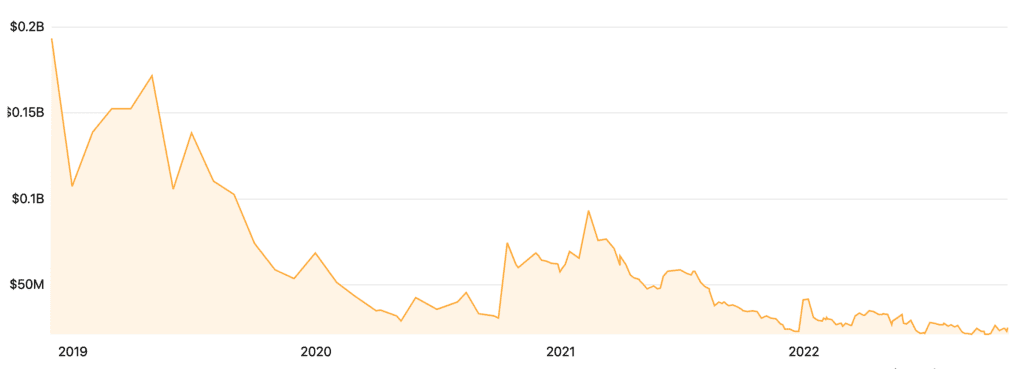

Earnings history for AgeX Therapeutics from 2018 to 2022 (Source)

Against a financial strategy to increase earnings with time, the company is in a challenging financial situation with a decreasing stock price and overall market capital.

Market cap history of AgeX Therapeutics from 2018 to 2022 (Source)

Lineage Cell Therapeutics (NYSE American Stock: LCTX)

Location: California, USA

Market Cap: $347.23 M.

Focus: Biotechnology & Cell Therapy

Founder & CEO: Brian M Culley

Lineage Cell Therapeutics is confidently leading the future of cell therapy worldwide. It is a clinical-stage biotechnology company with an aspiring pipeline of cellular therapy programs. They conduct research, development, and manufacturing of specialized human cells on their comprehensive longevity platform to replace or support dysfunctional or absent cells.

The company’s leading products are: OpRegen ($16 M. project), cell therapy to treat advanced dry age-related macular degeneration which has passed Phase 2a clinical trials; OPC1 ($14 M. project), cell replacement therapy to treat spinal cord injuries which has passed Phase 2a clinical trials; and VAC2 ($10 M. project), cell therapy product to treat non-small cell lung cancer which has passed Phase 1 clinical trials.

The published balance sheet highlights the company’s cash equivalents and marketable securities totaled $65.1 million as of September 30, 2021.

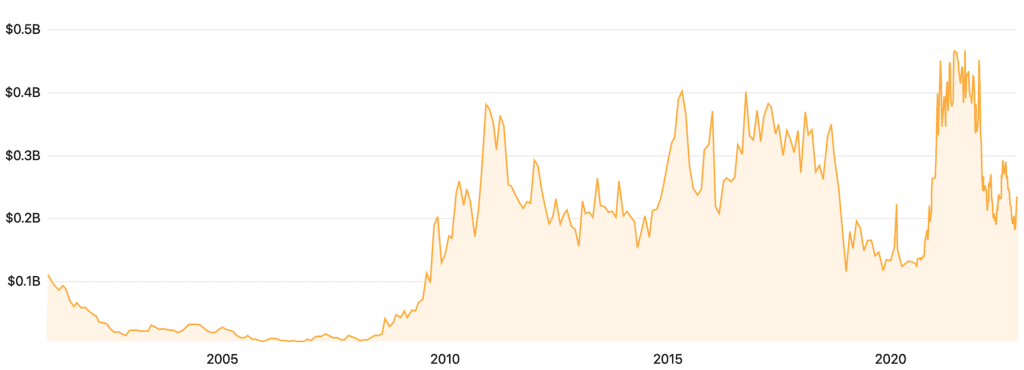

The growth of the market cap of Lineage Cell Therapeutics promises a growing trend in its stock prices. At the time of writing this article, the market cap has reached $0.35 Billion.

Market cap history of Lineage Cell Therapeutics from 2001 to 2022 (Source)

The Bottom Line

We have focused on three premium options for longevity investments in this article. First, Apollo Health Ventures is a solid organization with a strong company portfolio and high credibility in the team behind the venture and their success in raising funds.

Both AgeX Therapeutics and Lineage Cell Therapeutics have made profound advancements in cell therapy. They run two effective longevity platforms with active products in research that will be commercialized soon after overwhelming positive clinical trial results.

On the one hand, Agex Therapeutics seems like a risky investment at a very competitive stock price as a chance for investors to benefit from the strategic shift into increased earnings. On the other hand, Lineage Cell Therapeutics represents an opposite option of a stock that has a history in the market and steadily growing price and market cap, shielding risk-averse investors.

The longevity industry is proliferating, and it has many other successful examples that could be regarded for your investments in the future. Timeskipper will keep an eye open to inform you of this market’s big news.