Waking up from cryogenic sleep is likely to be a bitter-sweet experience. Sweet because one would get to live again, smell the air, taste the food, feel the joys once again. Bitter because friends and family who did not take the cryonic option would no longer be with us. How that life shapes up will depend on what one chooses to do with it. Spend it learning something new, travelling the world, doing and experiencing things never done before? Surely, the purpose of cryonics is not to put people to work again. As technology plays catch up to our ideas, it would be wise to manage one’s assets so that they remain valuable in the future. Luckily, the changing face of money today tells us what the future will be like.

The future of the US Dollar

The US dollar only came into being in 1792 and the once popular Roman currencies have found a home in museums and have no transactional value today. In the far future, it is likely that the US dollar will meet the same fate.

Even if one assumes that this will not occur, inflation will still hold true. A study showed that between the years 2000 and 2018, the price of a cup of coffee went up 26%. As time progresses, the value of a stack of money will reduce. The longer the cryogenic sleep, the lesser the purchasing capacity in the future.

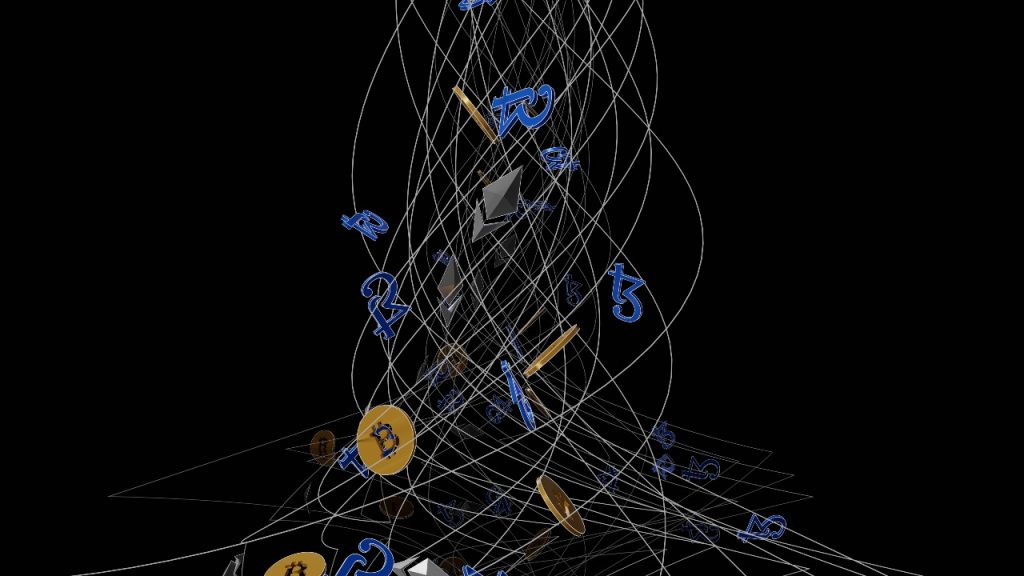

When planning asset management for post-cryonics life, diversifying one’s portfolio is a good idea. Apart from a global currency like the USD, where else can one put their money? The answer is obvious, cryptocurrencies.

Like traditional currency, cryptocurrencies are a means of exchange but only available digitally. Owners hold cryptocurrency units in their own name or under a pseudonym, which is known as the ‘address’. Records of ownership of all units of a cryptocurrency are public. Since arriving on the scene in 2009, cryptocurrencies have grown in number and popularity. Here are four reasons why they deserve a place in your asset portfolio:

Appreciating value

The rising value of cryptocurrencies is a testament to their future potential. One unit of the popular cryptocurrency, Bitcoin, was valued at 7 cents in 2010, and reached its all-time high price of $69,044 in November 2021. One of the reasons for their appreciation in value is the decentralized nature of blockchain technology, which allows for secure and transparent transactions without the need for intermediaries such as banks. Additionally, the limited supply of some cryptocurrencies, such as Bitcoin, has created a sense of scarcity and exclusivity that has helped drive up their value. As more people become aware of the potential benefits of cryptocurrencies, including their potential as a hedge against inflation and a means of facilitating cross-border transactions, their value is likely to continue to appreciate. And who doesn’t like a growing asset in a portfolio? However, the cryptocurrency market is highly volatile and investors should be cautious and do their own research before investing.

One man - varying interests

There is an underlying link between cryonics and cryptocurrency that is not widely known. In 2011, Ralph Merkle, a renowned computer scientist, was inducted into the National Inventors Hall of Fame for his work with cryptography. His pioneering work in the field has earned him an enviable place in the data structures used for cryptocurrencies. His concept of the ‘Merkle root’ and ‘Merkle tree’, are integral to hashing algorithms, needed to verify a transaction in cryptocurrency.

Merkle has been one of the Directors of cryonics company Alcor since May 21, 1998, and chaired the fourth and fifth Alcor conferences. His current work focuses on molecular nanotechnology aimed at curing diseases and restoring health. Merkle’s past work has ushered a new era in currencies while his current work will advance cryonics and post-cryogenic life. Merkle’s work is shaping our future in more ways than one.

Threats from quantum computing

All financial transactions taking place in the digital world use encryption as a safety net to prevent nefarious activity. Quantum computing – a term used for faster computers that can process more information in less time – is capable of breaking encryptions that are currently in use. As quantum computers become common, they will be used to carry out vicious attacks on financial systems that are a risk to all digital transactions.

Cryptocurrencies are built on computing technology and evolve with changes in the technology world. This makes them resilient to quantum attacks. As a matter of fact, cryptocurrencies are already using protocols that are quantum attack resistant.

Governments warming up to cryptocurrencies

In their short history, cryptocurrencies have faced stiff opposition from governments and central banks. Given their technological benefits, governments are now warming up to the technology. This offers more options to manage asset portfolios while also signalling that cryptocurrencies are the future of money.

One example of a government that has been relatively open to cryptocurrencies is Switzerland. The Swiss government has taken steps to create a supportive regulatory environment for blockchain technology and cryptocurrencies, including the establishment of a “Crypto Valley” in the city of Zug, which has become a hub for blockchain startups and cryptocurrency companies.

Another example would be El Salvador who made history in September 2021 by becoming the first country in the world to adopt Bitcoin as legal tender.

Overall, the adoption of cryptocurrencies by countries is a complex and evolving process, with many factors shaping the regulatory environment and the attitudes of governments and citizens. In any case, it’s clear that cryptocurrencies are transforming the way that people think about money, finance, and the global economy, and their impact is likely to be felt for years to come.

Hence, making the right choices in asset management can ensure that post-cryonics life is both stress-free and lets us do the things we are most passionate about.